Appraising and Umpiring

The appraisal process is a Policy Provision found in the Loss Settlement Section. It is an alternative to dispute resolution, which can resolve disagreements when a carrier and policyholder do not agree on the scope or amount of the loss. In many cases, it can be more cost effective than taking direct legal action against the carrier.

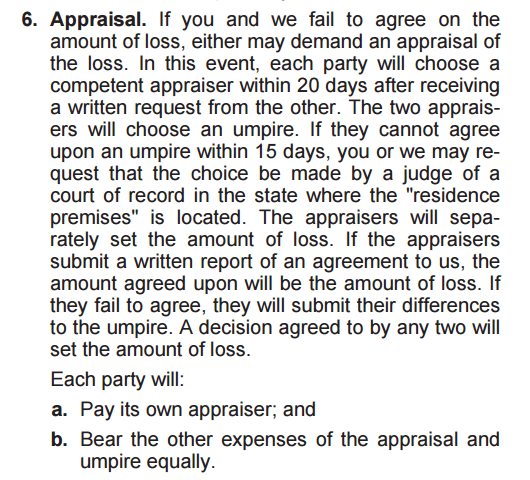

Example of a policy Appraisal Clause

wording may vary depending on the carrier.

Insurance appraisal is a binding alternative dispute resolution process that typically involves two independent appraisers who evaluate the claim, compare notes, and come to an agreement. When a disagreement arises between the property owner’s appraiser and the insurance company’s appraiser, an impartial umpire is suggested and agreed upon by both appraisers.

CDS Response has many years of experience in estimating, working in the field, and handling different types of insurance claims allows us to provide our clients with firsthand experience and the documentation necessary to prove your claim and receive a fair settlement.